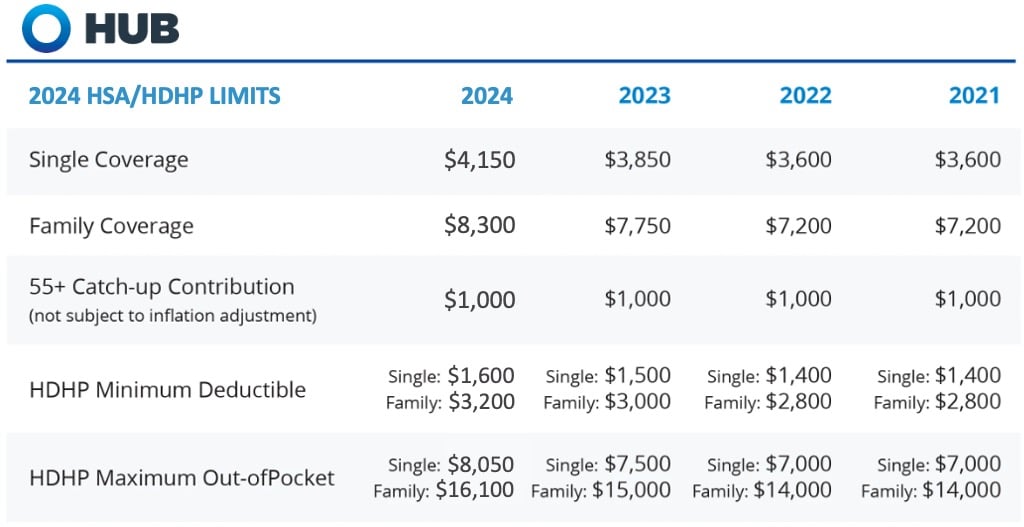

401k Limit 2025 Married Filing Jointly. If you are 50 or older, you can contribute an additional $7,500. Taxable income is calculated by subtracting your.

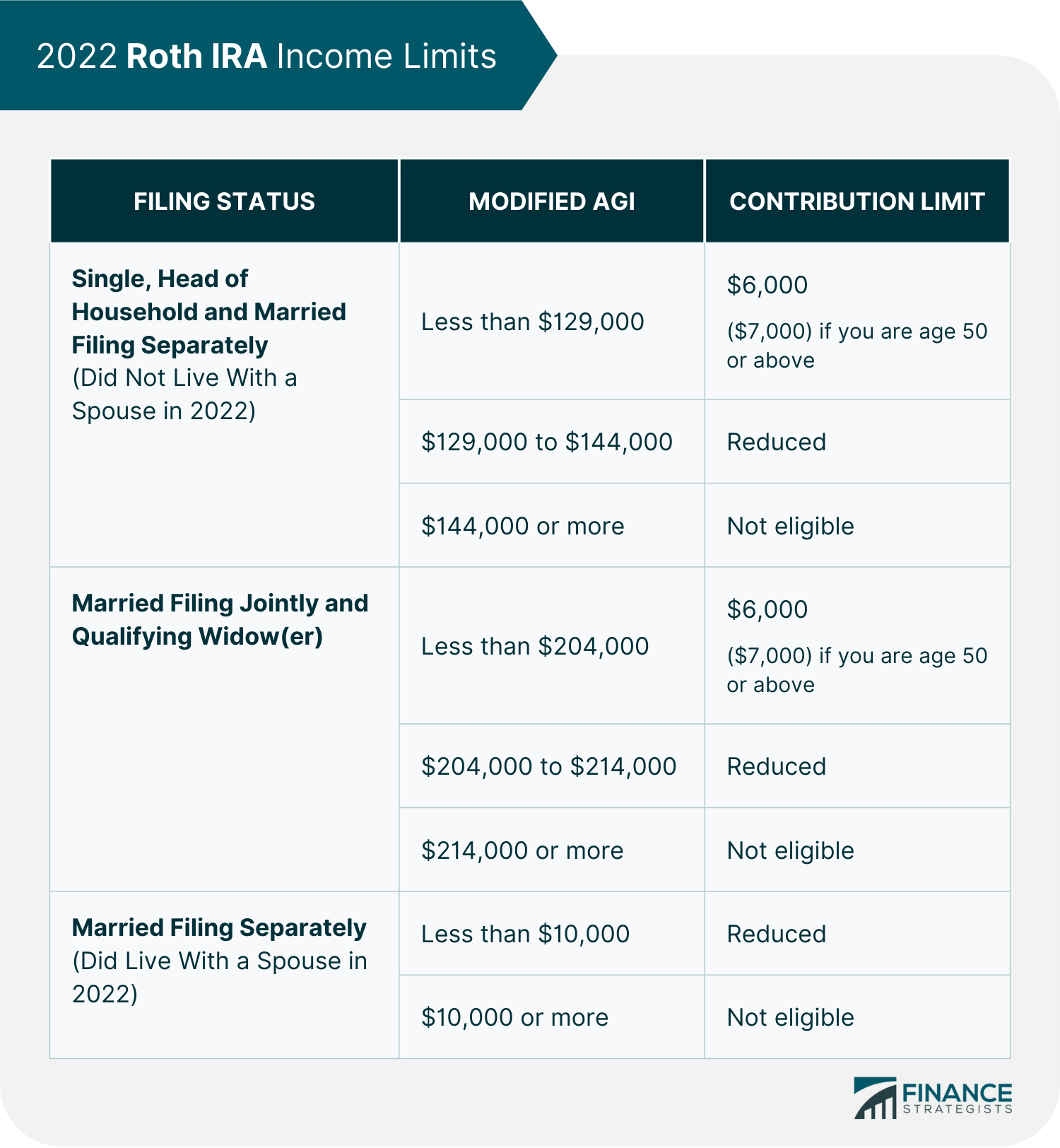

Amt ordinary income rate increases from 26% to 28% for alternative minimum taxable income over $232,600 (single and married/filing jointly). Here’s our roth ira growth calculator to help.

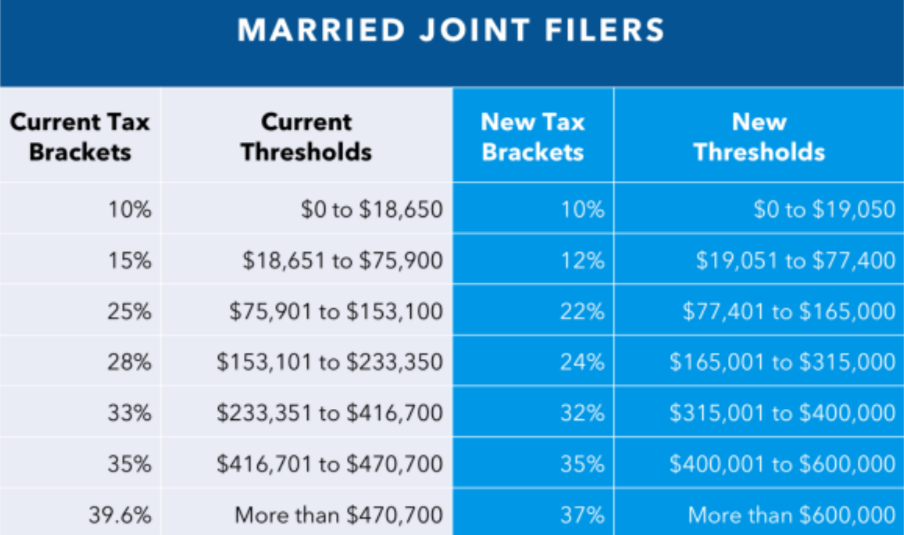

Roth Ira Contribution Limits 2025 Married Filing Jointly Per Person Josey Mallory, Income thresholds for tax brackets will increase by approximately 5.4% for 2025.

401k Limit 2025 Married Merci Stafani, Annual limit on salary reduction contributions to dependent care fsa.

Married Filing Jointly Roth Ira Limits 2025 Judy Clementia, Exemption amounts phase out beginning with alternative minimum taxable income over $1,218,700 (married/filing jointly) and $609,350 (single filers).

2025 401k Deferral Limits 2025 Married Filing Tobe Adriena, In 2025, the maximum 401(k) contribution limit is $23,000 for people under the age of 50.

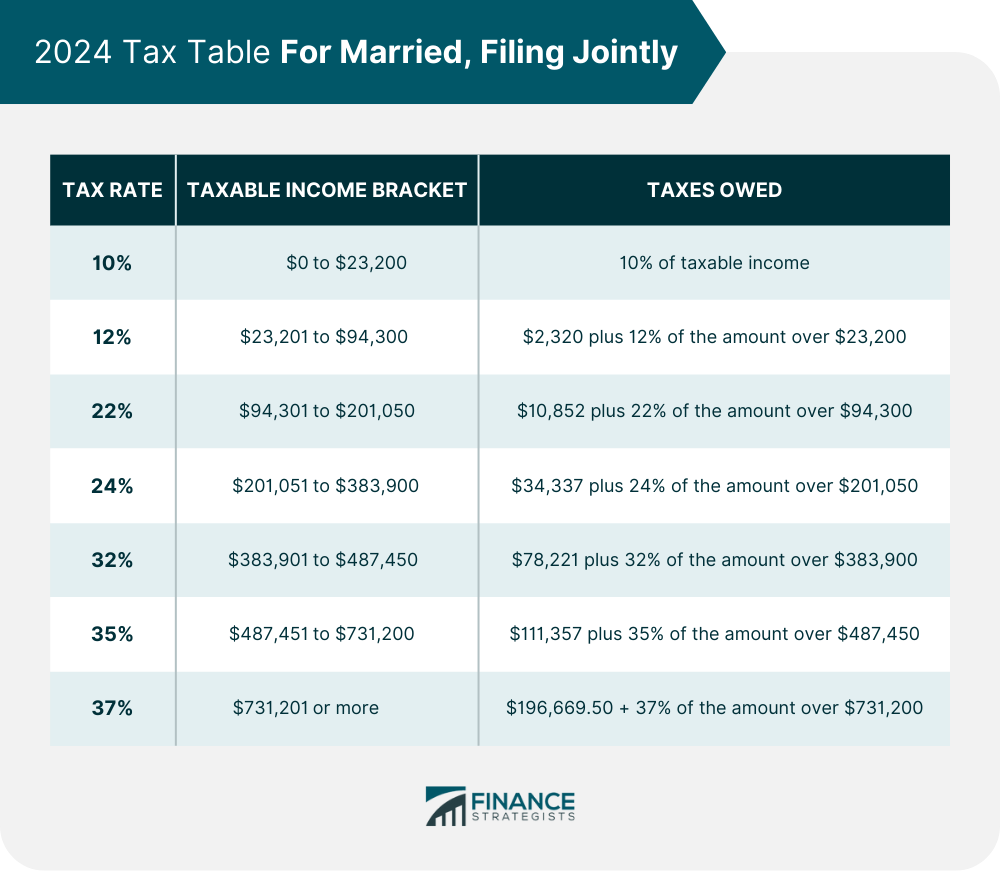

Tax Bracket 2025 Married Filing Separately Meaning Glen Philly, When you add employer contributions, the limit in 2025 is $70,000, up from $69,000 in 2025.

Roth Ira Limits 2025 Married Filing Jointly Karla Marline, If you collectively earn between $123,000 and $143,000, you can take a partial deduction.

2025 401k Deferral Limits 2025 Married Filing Tobe Adriena, The contribution limit for employees who have a 401(k) plan is $23,000 in 2025.

2025 Tax Brackets Married Filing Jointly Fey CarolJean, Employees can contribute up to $23,500 to their 401 (k) plan for 2025 vs.

Tax Brackets Definition, Types, How They Work, 2025 Rates, The contribution limit for employees who have a 401(k) plan is $23,000 in 2025.